Wells Fargo online credit cards offer a convenient and streamlined way to manage your finances. From the ease of online application to the comprehensive suite of digital tools, these cards provide a modern approach to credit. This exploration delves into the application process, features, benefits, security measures, and customer support, equipping you with the knowledge to make an informed decision.

We’ll uncover the intricacies of managing your account, understanding fees and APRs, and comparing Wells Fargo offerings to those of its competitors. Prepare to navigate the world of Wells Fargo online credit cards with confidence.

This guide provides a detailed overview of everything you need to know about Wells Fargo online credit cards, from initial application to ongoing account management. We’ll examine the various card types available, their respective features and benefits, and the security protocols in place to protect your financial information. By the end, you’ll have a comprehensive understanding of whether a Wells Fargo online credit card is the right choice for your financial needs.

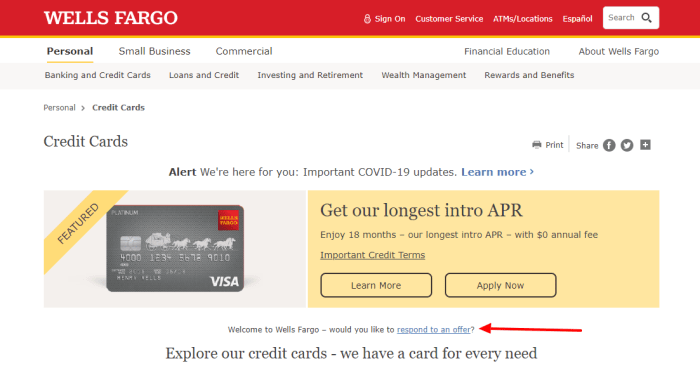

Wells Fargo Online Credit Card Application Process

Applying for a Wells Fargo online credit card is a straightforward process. This section details the steps involved, required documentation, and the various card types offered.

Online Credit Card Application Steps

Source: kcommunity.org

The application process typically involves these steps:

- Visit the Wells Fargo website and locate the credit card application section.

- Select the credit card that best suits your needs from the available options.

- Complete the online application form, providing accurate personal and financial information.

- Review the application and submit it electronically.

- Wells Fargo will review your application and may request additional documentation.

- You will receive a notification regarding the approval or denial of your application.

- If approved, you will receive your credit card in the mail.

Required Documentation for Application

To ensure a smooth application process, have the following documents ready:

- Social Security Number

- Date of birth

- Current address and previous address(es)

- Employment information (employer, income, etc.)

- Existing credit card information (if applicable)

Types of Wells Fargo Online Credit Cards

Wells Fargo offers a variety of online credit cards catering to different needs and spending habits. These may include cards with rewards programs, cash back options, and varying APRs. Specific card offerings change, so checking the Wells Fargo website for the most up-to-date information is crucial.

Wells Fargo Online Credit Card Application Summary

| Step | Action | Document | Card Type |

|---|---|---|---|

| 1 | Visit Wells Fargo website | None | Various |

| 2 | Select card | None | Rewards, Cash Back, etc. |

| 3 | Complete application | SSN, DOB, Address, Employment Info | Applicable to all |

| 4 | Submit application | None | Applicable to all |

| 5 | Await approval | May require additional documentation | Applicable to all |

Wells Fargo Online Credit Card Features and Benefits

Wells Fargo online credit cards offer a range of features and benefits designed to enhance the user experience and provide financial flexibility. These advantages often outweigh those of traditional credit cards.

Features of Wells Fargo Online Credit Cards

Common features include:

- Online account management

- Mobile app access

- Various rewards programs (cash back, points, miles)

- Fraud protection features

- Automatic payment options

- Credit score tracking (may vary by card)

Benefits of Wells Fargo Online Credit Cards

Using a Wells Fargo online credit card provides several key benefits over traditional cards:

- Convenience: Manage your account anytime, anywhere.

- Efficiency: Make payments and track transactions easily.

- Security: Enhanced security measures to protect against fraud.

- Rewards: Earn cashback or points on purchases.

Rewards Programs and Cashback Options

Wells Fargo offers various rewards programs depending on the specific credit card. These programs often provide cashback on everyday purchases or points that can be redeemed for travel, merchandise, or cash.

Comparison of Key Benefits of Three Wells Fargo Online Credit Cards

Note: Specific card offerings, benefits, and APRs are subject to change. This is a general comparison for illustrative purposes only. Always refer to the Wells Fargo website for the most current information.

- Card A (Example Rewards Card): High rewards rate on specific categories, potential annual fee, competitive APR.

- Card B (Example Cash Back Card): Flat-rate cash back on all purchases, no annual fee, potentially higher APR.

- Card C (Example Low APR Card): Low APR, limited or no rewards program, no annual fee.

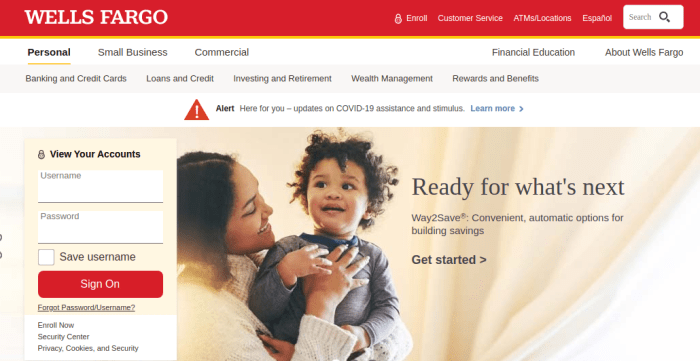

Managing Your Wells Fargo Online Credit Card Account

Managing your Wells Fargo online credit card account is simple and convenient through their online platform and mobile app.

Accessing and Managing Your Account Online

Access your account by visiting the Wells Fargo website and logging in with your online banking credentials. From there, you can view your account balance, transaction history, make payments, and manage your account settings.

Making Online Payments

Making online payments is straightforward. Log into your account and navigate to the payment section. You can typically schedule one-time or recurring payments from your checking or savings account.

Checking Your Credit Card Statement and Transaction History

Your credit card statement and transaction history are readily available online. Log into your account and access the statement and transaction sections to view detailed information about your spending and payments.

Disputing a Transaction

To dispute a transaction, follow these steps:

- Log into your Wells Fargo online account.

- Locate the transaction you wish to dispute.

- Follow the prompts to initiate a dispute, providing necessary details and documentation.

- Wells Fargo will investigate the dispute and notify you of their decision.

Security and Fraud Prevention for Wells Fargo Online Credit Cards

Wells Fargo employs robust security measures to protect customer data and prevent fraud. However, proactive steps by cardholders are equally important.

Security Measures Employed by Wells Fargo

Wells Fargo utilizes advanced security technologies such as encryption and fraud detection systems to safeguard customer information and transactions. They also monitor accounts for suspicious activity and take appropriate action.

Preventing Credit Card Fraud

To minimize the risk of fraud, consider these precautions:

- Monitor your account regularly for unauthorized transactions.

- Use strong, unique passwords for your online accounts.

- Be cautious of phishing scams and suspicious emails or text messages.

- Do not share your credit card information with untrusted sources.

- Report suspicious activity immediately.

Reporting Lost or Stolen Cards

If your card is lost or stolen, report it immediately to Wells Fargo by calling their customer service number (found on the back of your card) or through their online banking platform.

Best Practices for Online Credit Card Security

- Use a secure internet connection when accessing your online banking account.

- Keep your antivirus software updated.

- Avoid using public Wi-Fi for sensitive transactions.

- Regularly review your credit card statements for unauthorized charges.

- Sign up for fraud alerts from Wells Fargo.

Customer Service and Support for Wells Fargo Online Credit Cards

Wells Fargo provides various channels for customers to access customer service and support.

Contacting Wells Fargo Customer Service, Wells fargo online credit card

You can contact Wells Fargo customer service through several channels:

| Channel | Method | Expected Response Time |

|---|---|---|

| Phone | Call the customer service number on the back of your card. | Varies, but generally immediate assistance. |

| Use the online contact form on the Wells Fargo website. | May take several business days. | |

| Online Chat | Access live chat support through the Wells Fargo website. | Generally immediate assistance. |

Response Time for Customer Service Inquiries

Response times vary depending on the chosen contact method. Phone and online chat typically provide immediate assistance, while email inquiries may take longer.

Resolving Issues or Complaints

If you have an issue or complaint, Wells Fargo provides resources to resolve them. Begin by contacting customer service through your preferred channel. If the issue is not resolved, you may escalate the complaint to a higher level of support.

So, you’re checking out the Wells Fargo online credit card? That’s smart! But before you commit, maybe also peep the retirement options, like checking out the bank of america ira interest rates to see how your savings could grow. Then, armed with that info, you can totally slay your Wells Fargo credit card application, knowing you’re financially on point.

Wells Fargo Online Credit Card Fees and APR

Understanding the fees and APR associated with your Wells Fargo online credit card is crucial for responsible credit management.

Fees Associated with Wells Fargo Online Credit Cards

Common fees include:

- Annual fees (may vary depending on the card)

- Late payment fees

- Balance transfer fees (if applicable)

- Foreign transaction fees (if applicable)

- Cash advance fees

Annual Percentage Rate (APR) Calculation and Influencing Factors

The APR is the annual interest rate charged on your outstanding balance. Factors influencing your APR include your credit score, credit history, and the specific credit card terms.

Comparison of APRs for Different Wells Fargo Online Credit Cards

Source: mockofun.com

APRs vary significantly across different Wells Fargo credit cards. A rewards card might have a higher APR than a low-interest card. Check the specific terms for each card to compare APRs.

Fees and APR Comparison Table

| Fee | Description | Card Type A | Card Type B | Card Type C |

|---|---|---|---|---|

| Annual Fee | Annual charge for maintaining the card. | $0 | $95 | $0 |

| Late Payment Fee | Fee charged for late payments. | $39 | $39 | $39 |

| APR | Annual Percentage Rate. | 18% | 22% | 14% |

Comparing Wells Fargo Online Credit Cards to Competitors

Comparing Wells Fargo online credit cards to those offered by competitors allows for a more informed decision-making process.

Comparison of Features and Benefits

Wells Fargo competes with many major banks offering online credit cards. Competitors often provide similar features, such as online account management, rewards programs, and mobile apps. However, specific benefits, such as rewards rates and APRs, can vary significantly.

Advantages and Disadvantages of Choosing Wells Fargo

Source: activateyour.cards

Advantages might include established reputation, extensive branch network (for in-person assistance), and potentially competitive rewards programs. Disadvantages might include potentially higher APRs compared to some competitors or less generous rewards programs in certain card types.

Differences in APRs, Fees, and Rewards Programs

APRs, fees, and rewards programs differ across banks and even within the same bank’s offerings. Careful comparison is essential before selecting a card.

Comparative Table of Wells Fargo and Competitors

| Feature | Wells Fargo | Competitor A | Competitor B |

|---|---|---|---|

| APR (Example) | 18-24% | 15-21% | 17-23% |

| Annual Fee (Example) | $0-$95 | $0-$75 | $0-$100 |

| Rewards Program (Example) | Cash Back or Points | Cash Back | Miles |

Ending Remarks

Ultimately, choosing the right Wells Fargo online credit card hinges on aligning its features with your individual financial goals and spending habits. By carefully considering the APR, fees, rewards programs, and security measures, you can make an informed decision that optimizes your financial well-being. Remember, proactive account management and awareness of potential security risks are key to maximizing the benefits of your chosen card.

Embrace the convenience and control offered by Wells Fargo’s online platform, and embark on a journey towards smarter financial management.