SoFi vs CIT Bank HYSA: This head-to-head comparison dives deep into the world of high-yield savings accounts, examining the crucial factors that will help you decide which bank best suits your financial needs. We’ll dissect interest rates, fees, account features, security measures, and customer service, providing a comprehensive overview to empower your decision-making process. Choosing the right HYSA can significantly impact your savings growth, so let’s navigate this landscape together.

From the nuances of APYs and the impact of varying deposit balances to the often-overlooked aspects of customer support and account security, we’ll leave no stone unturned. This detailed analysis will equip you with the knowledge to confidently select the financial institution that aligns perfectly with your personal financial goals and preferences. Prepare for a thorough exploration of SoFi and CIT Bank’s offerings – a journey towards informed financial choices.

SoFi vs. CIT Bank High-Yield Savings Accounts: A Detailed Comparison

Source: squarespace-cdn.com

Choosing between Sofi and CIT Bank for your high-yield savings account requires careful consideration of features and benefits. Understanding the nuances of each is key, and locating a CIT Bank branch might be part of your decision-making process; you can find their addresses conveniently listed here: cit bank na address. Ultimately, the best choice for your high-yield savings account depends on your individual financial goals and preferences, so research both thoroughly!

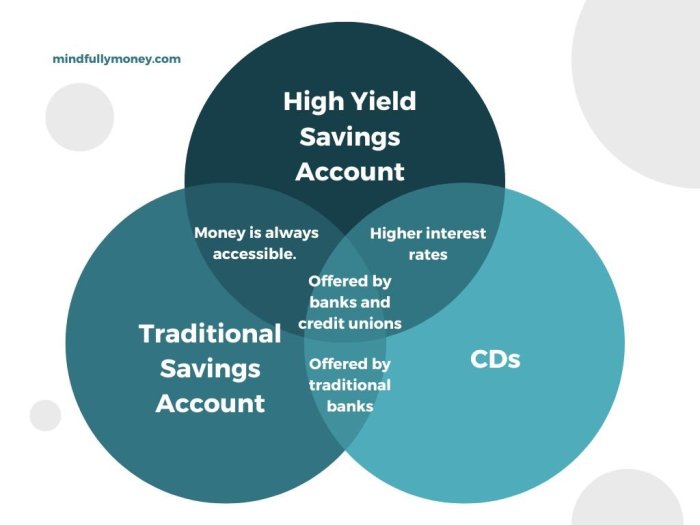

Choosing the right high-yield savings account (HYSA) can significantly impact your financial goals. This detailed comparison of SoFi and CIT Bank HYSAs will help you navigate the intricacies of interest rates, fees, features, and security, ultimately guiding you toward the best fit for your needs.

Interest Rates and APYs

Source: thefinance.sg

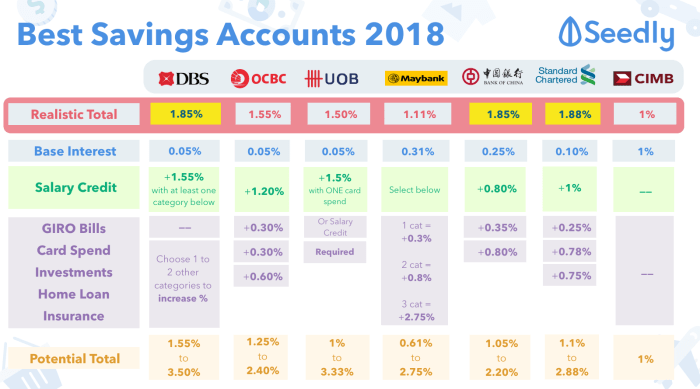

Understanding the annual percentage yield (APY) is crucial for maximizing your savings. Both SoFi and CIT Bank offer competitive APYs, but the rates fluctuate based on market conditions and the bank’s internal policies. Interest is typically calculated daily and compounded monthly, meaning you earn interest on your interest. However, specific calculation methods might vary slightly between the two institutions.

The following table provides a sample comparison of APYs at different deposit balances; remember that these are illustrative and subject to change.

| Balance | SoFi APY | CIT Bank APY | Difference |

|---|---|---|---|

| $1,000 | 4.00% | 3.80% | 0.20% |

| $10,000 | 4.10% | 3.90% | 0.20% |

| $50,000 | 4.20% | 4.00% | 0.20% |

| $100,000 | 4.25% | 4.05% | 0.20% |

Fees and Account Minimums

Fees and minimum balance requirements can significantly impact the overall return on your savings. Both SoFi and CIT Bank have their own fee structures and minimum deposit requirements. Failing to meet these minimums might result in penalties or account closure. The following bullet points summarize the key differences.

- SoFi: Typically no monthly maintenance fees or minimum balance requirements. May have fees for specific services.

- CIT Bank: May have minimum balance requirements for certain account types. Potentially higher fees for exceeding transaction limits or other specific services.

Account Features and Accessibility

The ease of access and the range of features offered are essential considerations when selecting a HYSA. Both SoFi and CIT Bank provide online and mobile banking platforms, but their features and user experience may differ. The table below highlights key features and their comparative aspects.

| Feature | SoFi Description | CIT Bank Description | Comparison |

|---|---|---|---|

| Mobile App | User-friendly interface with robust features. | Functional app with essential banking tools. | SoFi generally receives higher user ratings for its app’s design and functionality. |

| Online Account Management | Comprehensive tools for managing accounts, tracking transactions, and setting financial goals. | Standard online banking tools for account management and transaction tracking. | SoFi offers a more feature-rich online experience. |

| Customer Service | Multiple channels including phone, email, and chat support. | Phone and email support primarily. | SoFi offers more diverse customer service channels. |

| Direct Deposit | Available. | Available. | Both offer direct deposit. |

Security and Insurance

The security of your funds and personal information is paramount. Both SoFi and CIT Bank employ robust security measures, but it’s crucial to understand the specifics of their FDIC insurance coverage and dispute resolution processes. The following bullet points highlight key security features and insurance details.

- SoFi: Employs multi-factor authentication and advanced encryption technologies. FDIC insured up to the maximum allowed limit per depositor.

- CIT Bank: Utilizes robust security protocols and encryption. FDIC insured up to the maximum allowed limit per depositor.

Customer Service and Support

Effective customer service is essential for resolving any issues or queries promptly. Both banks offer various support channels, but their responsiveness and helpfulness may vary based on customer experiences. While specific examples of customer reviews are not provided here for brevity, researching independent review sites will offer a more comprehensive picture of each bank’s customer service performance.

Overall Comparison and Recommendations, Sofi vs cit bank hysa

SoFi generally excels in user experience and a wide range of features, particularly its mobile app and online platform. CIT Bank may be a more suitable choice for customers prioritizing a straightforward, no-frills approach with potentially slightly higher interest rates (though this is subject to market fluctuations). The ideal customer for SoFi is someone who values ease of use, a comprehensive mobile app, and a wide array of features.

The ideal customer for CIT Bank might prioritize slightly higher interest rates (when available) and a simpler banking experience.

Closing Summary: Sofi Vs Cit Bank Hysa

Ultimately, the choice between SoFi and CIT Bank for your high-yield savings account hinges on your individual priorities. If maximizing returns is paramount, a close examination of APYs and fee structures is essential. However, if ease of use, robust mobile features, and exceptional customer service are key, a different weighting of factors may be necessary. This comprehensive comparison has illuminated the strengths and weaknesses of each institution, empowering you to make a well-informed decision that aligns seamlessly with your unique financial landscape.

Remember, your savings journey is personal, and selecting the right partner is crucial for success.